13.55% of the initial token allocation is held by the creator.

Creator token stats last updated: Jun 30, 2025 00:02

The following is generated by an LLM:

Summary

conflicting AI stablecoin narrative vs yield protocol reality

Analysis

Falcon Finance presents conflicting narratives between its initial pitch (AI-powered stablecoin using voice data analysis) and documentation (synthetic dollar protocol with yield strategies). While the project demonstrates technical depth in its whitepaper and has institutional partnerships (Fireblocks, BitGo), the core concept suffers from cognitive dissonance between marketing materials and actual implementation. The 13.55% creator allocation is reasonable, and security measures like MPC custody mitigate some risks. However, the unnecessary complexity of combining AI data valuation with synthetic dollar mechanics creates operational uncertainty. The project's KYC requirements and $485M TVL suggest legitimate traction, but the fundamental premise of needing a new stablecoin token rather than using existing solutions remains questionable.

Rating: 4

Generated with LLM: deepseek/deepseek-r1

LLM responses last updated: Jun 30, 2025 00:02

Original investment data:

# Falcon Finance ($FALCON)

URL on launchpad: https://app.virtuals.io/prototypes/0x7Fa340c3fcF6D5beF18c172c1e9808eEb8ba475F

Launched at: Sun, 29 Jun 2025 23:57:36 GMT

Launched through the launchpad: Virtuals Protocol

Launch status: UNDERGRAD

## Token details and tokenomics

Token address: 0x7Fa340c3fcF6D5beF18c172c1e9808eEb8ba475F

Top holders: https://basescan.org/token/0x7Fa340c3fcF6D5beF18c172c1e9808eEb8ba475F#balances

Liquidity contract: https://basescan.org/address/0x9E7f1caa853A4AD696Dc4fbEcfF8912B04005eA9#asset-tokens

Token symbol: $FALCON

Token supply: 1 billion

Creator initial number of tokens: Creator initial number of tokens: 135,508,969 (13.55% of token supply)

## Creator info

Creator address: 0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f

Creator on basescan.org: https://basescan.org/address/0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f#asset-tokens

Creator on virtuals.io: https://app.virtuals.io/profile/0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f

Creator on zerion.io: https://app.zerion.io/0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f/overview

Creator on debank.com: https://debank.com/profile/0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f

## Description at launch

Falcon Financ is the first AI-powered stablecoin that leverages advanced artificial intelligence to maintain its peg to the US dollar with remarkable precision. By employing a network of AI agents, Falcon Stable dynamically adjusts its supply in response to market conditions, ensuring stability and trust among users. These AI agents monitor economic indicators in real-time, enabling the stablecoin to react swiftly to any volatility, thus offering a level of reliability.

## Overview

**Falcon Finance Whitepaper**

1\. Project Overview and Core Value Proposition

## **1.1 Project Positioning**

**Falcon** is the world’s first decentralized infrastructure that combines AI Agents, Web3 data ownership, and voice data assetization. Voice data has long been fragmented, underutilized, and undervalued — **Falcon** redefines its value. Through the integration of smart hardware, intelligent agents, and AI-powered data valuation engines, **Falcon** transforms every voice data fragment into a tradable digital asset fully owned by users. This empowers personal data sovereignty, drives the co-creation of AI data ecosystems, and ensures fair revenue distribution across all participants.

## **1.2 Core Value Proposition**

**Falcon** redefines data value discovery and distribution systems, offering five key advantages:

\- **Evolution of Data Valuation Models:** Traditional platforms price data roughly based on duration or upload volume, failing to reflect actual data value. **Falcon** employs a six-dimensional intelligent valuation system with a dynamic scarcity pricing mechanism, accurately assessing each data set's unique value. This system can boost data contributor revenue by 10 to 100 times compared to traditional platforms.

\- **Revolution in Data Ownership**: Unlike traditional platforms where uploaded data becomes platform-owned, **Falcon** ensures permanent ownership for contributors via Web3 on-chain confirmation. Users continuously benefit from long-term data usage, circulation, and licensing.

\- **First-Principle Data Value**: Data is inherently valuable at the edge — naturally occurring, user-generated, and deeply personal. Voice data, in particular, has long been fragmented, underutilized, and undervalued. **Falcon** unlocks this first-principle asset class by turning voice into structured, owned, and tradable data assets.

\- **Optimized Incentive Models**: Traditional platforms often offer one-time rewards for uploads, lacking long-term incentives. **Falcon** introduces staking-based weighted returns and dynamic compounding yield mechanisms. Long-term data contribution and ecosystem participation enable compounding asset growth.

\- Fully Unlocked Market Liquidity: Traditional data remains trapped within platforms. **Falcon** transforms data into NFTs, enabling decentralized trading, cross-chain ownership, and cross-platform circulation, unlocking liquidity and pricing efficiency.

**2. System Architecture Overview**

**Falcon** consists of four core modules, each fulfilling critical functions:

## **2.1 Hardware Collection Layer**

\- Utilizes portable **Falcon** smart recording hardware with advanced microphone array noise reduction.

\- Supports real-time, multi-language voice capture with high accuracy even in noisy environments.

\- Includes offline caching to ensure secure local storage when disconnected from the internet.

## **2.2 AI Agent Layer**

\- Hybrid architecture combining local and cloud-based Agents.

\- Performs speech recognition, real-time transcription, deep semantic understanding, scarcity detection, and valuation.

\- Continuously optimizes pricing models and value extraction using AI-driven multi-dimensional analysis.

## **2.3 DSP Layer (Data Service Platform)**

\- Core data service hub offering task matching, quality validation, asset minting, and revenue distribution.

\- Enterprises can issue customized data collection, labeling, and pre-processing tasks automatically matched to optimal contributors.

\- Provides automated on-chain data ownership, NFT minting, and transparent income distribution.

## **2.4 Blockchain Ownership Layer**

\- On-chain data asset system managing ownership, revenue distribution, and governance rights.

\- Supports staking governance, revenue sharing, and incentive control mechanisms.

\- Incorporates zero-knowledge proofs and privacy-preserving computations for secure and compliant data usage.

3\. **Falcon** Agent Layer: Intelligent Data Value Extraction Architecture

## **3.1 Architecture Overview**

The Agent Layer uses an AI-driven decision architecture where AI Agents autonomously discover, evaluate, and extract data value from voice inputs gathered via hardware devices. Moving beyond rule-based systems, it leverages ML models and LLMs for logical reasoning and valuation.

## **3.1.1 Design Principles**

\- AI Agent First: Core decisions are AI-led, with rule engines offering auxiliary fallback.

\- Value Discovery Driven: Prioritizes uncovering commercial value within the data itself.

\- Privacy by Design: Ensures privacy compliance throughout processing, mitigating leakage risks.

## **3.1.2 System Modules**

\- Data Collection & Storage: Encrypted, anonymized data uploaded to distributed data lake.

\- Pre-Processing: Speech transcription, semantic parsing, sentiment analysis generates structured data.

\- AI Agent Valuation: Deep analysis outputs scoring and labels.

\- Task Orchestration: Coordinates data flow, task scheduling, and decision execution.

## 3.2 Data Collection and Storage

## 3.2.1 Collection Process

In this phase, voice data is collected using customized hardware firmware. Devices apply local noise reduction algorithms to eliminate environmental noise. Embedded encryption algorithms (symmetric or hybrid) encrypt raw data for secure transmission. Before upload, sensitive information such as names, phone numbers, and addresses is anonymized through keyword dictionaries and entity recognition models.

For unstable network environments, segmented transmission is used. Audio recordings are split into multiple fragments, each uploaded independently with breakpoint resumption capability for interrupted uploads.

Uploaded data is stored in **Falcon**'s distributed data lake, utilizing object storage technology with version control and redundant backups to ensure data security and availability.

## 3.2.2 Data Privacy and Security

\- End-to-End Encryption: Full-chain encryption from device to cloud using TLS and application-level encryption.

\- Local Anonymization: Sensitive entity recognition, rule filtering, and content labeling ensure personal data is stripped prior to upload.

\- Access Control: Role-based access control (RBAC) and least privilege principles restrict module-level access rights.

\- Audit Logs: All data access is logged for security auditing and traceability.

## 3.2.3 Data Processing Workflow

\- **P**re-processing Trigger: The orchestration system fetches new data batches for speech recognition and transcription.

\- Semantic Structuring: NLP models extract keywords, identify topics, disambiguate semantics, and generate sentiment labels, outputting standardized structured formats.

\- Value Evaluation Execution: Structured data is scored by AI Agent models using multi-factor valuation logic.

\- Incentive Coefficient Calculation: Contributor incentive coefficients are calculated based on data value, scarcity, and other multi-dimensional factors.

\- Storage Confirmation: Each uploaded data fragment is assigned a unique identifier with version control and archived.

\- Ownership Synchronization On-chain: After all processing is complete, data hashes and user DIDs are written to the blockchain to finalize ownership confirmation.

## 3.3 Data Pre-processing Module

## 3.3.1 Speech Recognition and Transcription

Audio data enters ASR models trained on industry-specific corpora. Acoustic and language models jointly infer transcripts, handling accents, speeds, and technical terms robustly. Custom hotword dictionaries can be added for specialized domains.

## 3.3.2 Semantic Parsing and Sentiment Analysis

\- Lexical Analysis: Converts sentences into part-of-speech tags and dependency trees.

\- Keyword Extraction: Identifies core topic words and entities.

\- Topic Classification: Uses LLMs for contextual understanding and topic recognition.

\- Disambiguation: Sliding window context adjusts word sense interpretations.

\- Sentiment Analysis: Multi-classifiers label sentiment (positive, neutral, negative) with confidence scores.

## 3.3.3 Standardization and Structuring

\- Character Encoding: Unified formats like UTF-8.

\- Timeline Alignment: Uses timestamps and speaker separation models.

\- Noise Filtering: Removes duplicates, silence, and irrelevant segments.

\- Output Format: {Speaker ID, Timestamp, Text Content, Topic Tags, Sentiment Tags}.

## 3.4 AI Agent Valuation Module

Within the **Falcon** ecosystem, the Agent Layer serves as the intelligent core of the entire data valuation process, performing end-to-end, automated evaluation of voice data, transforming raw audio into fully quantified digital assets. The system’s core valuation workflow consists of five key stages:

## 3.4.1 Intelligent Perception and Semantic Understanding

The valuation process begins with multimodal perception. The system first conducts comprehensive quality checks on the incoming audio data, evaluating technical parameters such as signal-to-noise ratio (SNR), sampling rate, and data completeness to ensure data usability. Real-time transcription is then performed across more than 30 languages using state-of-the-art speech recognition models (e.g., Whisper, Wav2Vec2). Simultaneously, emotional features such as tone and sentiment are extracted through transformer-based emotion classification models. Speaker identity features are captured via advanced speaker embedding algorithms (e.g., x-vector, ECAPA-TDNN), enabling individual-level deduplication and traceability.

Once transcription is complete, the semantic understanding module is activated. This module generates deep semantic embeddings using models such as BERT and RoBERTa, quantifying linguistic logic, information density, and domain complexity. Named entity recognition automatically extracts key entities such as people, organizations, locations, and events, while knowledge relationship extraction (e.g., OpenIE) identifies logical dependencies and causal chains, further enriching data structure. A fusion algorithm integrates both semantic and emotional dimensions to construct a comprehensive semantic profile for each data record.

## 3.4.2 Scenario Identification and Commercial Value Estimation

Following semantic analysis, the scenario recognition module evaluates the data’s real-world application context and commercial potential. Acoustic scene classification models identify recording environments (e.g., meeting rooms, construction sites, outdoor spaces). Dialogue pattern detection algorithms classify the conversation type (monologue, multi-party discussion, or interview). Industry domain classification is automatically performed based on language patterns and domain-specific keywords (e.g., healthcare, legal, education, finance). Leveraging historical market data, the system applies gradient boosting models (e.g., XGBoost) to estimate the potential market value of the data for AI training marketplaces. Contextual metadata such as timestamps, device state, and geographic location are incorporated to construct a holistic usage profile for each dataset.

## 3.4.3 Six-Dimensional Valuation Model and Hybrid Decision Engine

All semantic and contextual insights are fed into **Falcon**’s proprietary Hybrid Valuation Engine, which combines AI-driven inference with rule-based scoring logic:

AI Agent Layer: Advanced language models (e.g., GPT-4, Claude) apply complex reasoning based on structured prompt engineering, generating comprehensive valuation outputs and confidence scores.

Rule Engine Layer: Traditional rule-based algorithms apply long-standing scoring weights and consistency rules to normalize technical metrics such as length, sampling rate, SNR, and semantic density.

Fusion Decision Layer: Bayesian inference algorithms integrate both AI and rule-based evaluations, balancing decision flexibility with system stability.

Anomaly Detection & Traceability: Built-in safeguards ensure transparency and auditability under outliers, noisy data, or edge cases, while maintaining interpretability.

The six core valuation dimensions include:

\- Technical Quality: Foundational data usability metrics.

\- Content Value: Semantic depth and informational complexity.

\- Scarcity: Linguistic uniqueness and corpus rarity.

\- Market Demand: Dynamic supply-demand indicators and enterprise training needs.

\- Application Potential: Suitability for AI model training and transfer learning.

\- Compliance & Safety: Legal, privacy, and regulatory compliance screening.

These six dimensions collectively determine the core multiplier logic of data valuation, which, when combined with incentive coefficients, directly inform final revenue allocation weights.

## 3.4.4 Scarcity, Market Forecasting, and Risk Control Agents

Beyond the core valuation system, xKnown deploys three auxiliary Agent modules to enhance value precision and control systemic risks:

Scarcity Discovery Agent: Quantifies linguistic rarity, content uniqueness, and temporal novelty using global language frequency databases, local-sensitive hashing (LSH) for de-duplication, and semantic embedding comparisons. The resulting scarcity score is directly applied to high-multiplier incentives.

Market Prediction Agent: Forecasts future demand for data assets using time-series models (e.g., LSTM, Prophet), supply-demand simulations, price elasticity analysis, and Monte Carlo scenario modeling. It integrates social sentiment signals from media and networks to capture short-term market expectations.

Risk Assessment Agent: Performs real-time legal and reputational risk evaluation through PII detection, automated GDPR/CCPA compliance checks, brand reputation keyword filtering, and unsafe content moderation APIs. Risk scores are applied as revenue deduction buffers or dataset exclusion filters.

## 3.4.5 Value Multiplier Algorithm Description

Following the six-dimensional base scoring, **Falcon** applies a Value Multiplier Algorithm to dynamically adjust the final reward weight for each data asset. At its core, the algorithm leverages an S-curve gradient function to smoothly map score intervals, preventing extreme incentive distortion at both low and high ends of the scoring spectrum.

The algorithm first calculates a base multiplier for each evaluation dimension, derived from its normalized score (0-100). Subsequently, the multiplier incorporates user-specific participation parameters drawn from the incentive layer—such as staking volume, contributor tier, and community engagement—stacking staking incentives, tier bonuses, and community contribution boosts to form the final enhancement coefficient. Throughout the computation, dimension-specific caps ensure that multiplier outputs remain within predefined system-safe boundaries to preserve platform stability.

## 3.4.6 Evaluation Output & Pricing Delivery

Upon completing the full assessment workflow, the system generates a comprehensive Valuation Report for each individual voice data asset. This report consolidates all six-dimensional scores, scarcity metrics, market demand forecasts, risk assessments, and fused decision outputs from both AI-driven and rule-based engines.

For example, if a data sample achieves high technical quality, rich semantic content, strong scarcity attributes, favorable market demand, and broad application potential, while maintaining minimal compliance risks, the system will assign it a higher value multiplier through this comprehensive assessment.

The resulting valuation serves as the definitive pricing reference for multiple downstream mechanisms: NFT minting, revenue sharing, staking weight allocation, and secondary market liquidity. Each valuation report remains fully traceable and explainable, providing transparent governance, transaction fairness, and ecosystem credibility.

## 3.5 Agent Workflow Orchestration

The Agent Workflow Orchestration Layer serves as the central control logic of the **Falcon** intelligent valuation system. Its mission is to coordinate complex multi-agent tasks into a highly efficient, scalable, and fault-tolerant end-to-end processing pipeline, ensuring stable real-time valuation even under high concurrency and heterogeneous task loads.

## 3.5.1 Workflow-Based Agent Architecture

At the core of the orchestration design lies a workflow-driven execution framework, which decomposes the full data valuation pipeline into modular, independently executable stages. Each AI Agent is registered as a distinct node within this workflow, enabling flexible composition, parallelization, and dynamic optimization.

Key architectural principles include:

\- Task modularization: Complex valuation is broken down into discrete and reusable Agent functions (e.g. transcription, semantic embedding, scene recognition, dimensional scoring).

\- Directed Acyclic Graph (DAG) scheduling: Inter-task dependencies are mapped as DAG structures, ensuring strict data integrity across sequential and parallelized stages.

\- Agent isolation: Each Agent operates independently, allowing flexible orchestration of AI models with varying compute demands, model sizes, and failure isolation domains.

## 3.5.2 Workflow Engine Implementation

The orchestration engine parses and manages full pipeline execution using a DAG-based system, dynamically analyzing dependencies and optimizing compute allocation.

Core execution logic includes:

\- DAG parsing and dependency resolution to derive optimal execution plans.

\- Compute resource allocation based on available system GPUs, CPUs, and memory pools.

\- Concurrent task scheduling for parallelizable Agents.

\- Result aggregation, merging intermediate Agent outputs into unified valuation records.

\- Exception handling through task retries, fallbacks, and graceful degradation under fault scenarios.

\- This workflow engine ensures deterministic, explainable execution traces across billions of data records, providing both high throughput and auditability.

## 3.5.3 Intelligent Scheduling & Optimization

To maintain optimal processing performance under fluctuating workloads, the system integrates a real-time Intelligent Workflow Scheduler that continuously monitors execution states and dynamically reallocates resources.

Key scheduling algorithms include:

\- Critical Path Analysis (CPM): Identifies latency-sensitive execution chains to minimize bottlenecks.

\- Resource-Constrained Optimization: Balances Agent assignments across compute clusters given GPU/CPU availability.

\- Predictive Scheduling: Learns from historical execution times to anticipate future task durations.

\- Dynamic Rebalancing: Actively shifts task priorities in real time based on live system load and valuation importance.

\- By continuously analyzing compute saturation, task wait times, and Agent health, the scheduler ensures stable valuation output even during surges of high-value data submissions.

## 3.5.4 Real-Time Monitoring & Failure Recovery

The Workflow Monitoring Manager operates alongside orchestration to ensure system observability, anomaly detection, and automated failure recovery.

Monitoring mechanisms include:

\- Real-time metrics: Collects Agent-level execution latency, compute usage, and task success rates.

\- State persistence: Logs full workflow execution checkpoints into distributed Redis clusters.

\- Anomaly detection: Applies statistical models to flag abnormal execution patterns or model drifts.

\- Resilient recovery: Supports checkpoint-based job restarts and fallback model substitutions upon fault triggers.

\- Performance tuning: Continuously adjusts Agent resource allocation to eliminate bottlenecks.

\- The orchestration layer guarantees that even under extreme workloads or partial system faults, valuation pipelines maintain both continuity and full auditability.

## 3.6 Web3-based Data Ownership and Provenance

## 3.6.1 Ownership Logic

\- Each dataset generates a unique data hash fingerprint upon ingestion.

\- Decentralized identifiers (DID) bind data to user identity.

\- Smart contracts anchor ownership, timestamps, hashes, and rights on-chain.

\- Ownership records are stored on public or consortium blockchains for transparency and auditability.

## 3.6.2 Ownership Benefits

\- Trusted Provenance: Prevents forgery and unauthorized tampering.

\- Assetization: Enables licensing, trading, and revenue sharing.

\- Cross-Platform Trust: Enhances usability in multi-party collaborations.

\- Compliance & Auditing: Satisfies regulatory traceability requirements.

## 3.7 System Security and Scalability

\- End-to-end encryption across device, transmission, storage, and processing layers.

\- Regulatory compliance with GDPR, CCPA, and domestic data laws.

\- Full audit trails for reasoning logic, score revisions, and model versioning.

4\. DSP Layer - Data Service Platform

## 4.1 Overview

The Data Service Platform (DSP) serves as the primary commercial interface of the xKnown ecosystem, enabling trusted, privacy-preserving, and verifiable data exchange between contributors, AI developers, enterprises, and model builders. Acting as both a data marketplace and an AI asset brokerage layer, DSP bridges raw data supply with structured AI demand through a multi-sided platform architecture.

The DSP layer supports three major roles:

\- C-side (Data Contributors): Individuals upload their personal data or perform micro-data tasks such as annotation, labeling, or transcription. Uploaded data undergoes initial quality screening by AI Agents to ensure minimal acceptance thresholds.

\- B-side (Enterprise & AI Developers): Organizations can submit customized data acquisition requests (Call-for-Data Services), issue real-time crowdsourcing tasks, and subscribe to verified datasets pre-qualified by xKnown's agent-based valuation system.

\- AI Marketplace: An open marketplace for trading AI assets, including datasets, pre-trained models, AI Agents, and workflow pipelines. Developers and AI builders may purchase clean, high-value datasets or offer proprietary models, with flexible licensing and monetization structures. DSP may also collaborate as a syndication partner to third-party AI marketplaces such as Sahara AI.

## 4.2 Privacy-Preserving Data Valuation Protocol

Given the sensitivity of personal data, the DSP integrates multiple privacy-preserving valuation techniques to ensure that:

\- Agent-based valuation can occur without raw data leakage.

\- Data contributors retain sovereignty over their private content.

\- Valuation results are still transparent, auditable, and usable for transaction settlement.

The core privacy-enhanced valuation stack combines:

\- Differential Privacy (DP): To inject calibrated noise during valuation aggregation, ensuring individual record privacy is maintained.

\- Homomorphic Encryption (HE): Enables AI Agents to compute partial valuation scores directly over encrypted feature vectors, without decrypting sensitive inputs.

\- Secure Multi-Party Computation (SMPC): Supports joint valuation between multiple stakeholders without full data exposure.

\- Shapley-Value Inspired DP Extensions: Leverages advanced Shapley value calculations, incorporating differential privacy to estimate marginal data contributions under privacy constraints, allowing buyers to assess expected value prior to direct access.

In practice, B-side buyers may access summary valuation scores derived from encrypted pipelines, but cannot retrieve raw data unless authorized through contractual settlement.

## 4.3 Fully Verifiable Batch Data Trading Protocol

To support scalable enterprise-grade data transactions, DSP implements a zero-knowledge-based settlement mechanism that allows bulk dataset exchanges between multiple sellers and institutional buyers. The full protocol proceeds as follows:

*More details about this part can be found by our website.*

This mechanism enables:

\- Trustless multi-party batch transactions.

\- Decentralized settlement and escrow through blockchain.

\- Full data privacy preservation until transaction finalization.

\- Flexible pricing structures linked directly to individual valuation scores.

## 4.4 DSP Platform Positioning within **Falcon**

The DSP layer functions not only as a marketplace but as a complete trust-minimized data brokerage protocol stack:

\- Fully integrated with **Falcon**’s upstream AI Agent valuation pipeline;

\- Powered by encrypted valuation models that balance privacy and transparency;

\- Enabling cross-border, multi-party institutional data commerce at scale;

\- Providing composability for enterprise-specific marketplaces, licensing syndication, and cross-chain data liquidity.

5\. Token Model

## 5.1 Ecosystem Roles

xKnown's decentralized collaboration ecosystem revolves around $XKNOWN as the core engine, connecting data contributors, enterprise users, model developers, and governance participants through an incentive-aligned token system. Four primary ecosystem roles are defined:

**(1) Data Contributors**

\- Individuals collect and upload voice data.

\- Earn $XKNOWN rewards based on data quality, usage frequency, and labeling accuracy.

\- Can authorize enterprises to license data for additional revenue sharing.

**(2) Data Consumers (Enterprises / Developers)**

\- Enterprises (e.g. AI firms, corporate clients) submit data requests via DSP.

\- Pay data access and task customization fees using $XKNOWN.

\- Submit requests for semantic labeling, rare language collection, or multilingual training sets.

**(3) DSP Node Operators**

\- Operate service nodes for task scheduling, data validation, and governance voting.

\- Stake $**Falcon** tokens as operational collateral.

\- Receive revenue shares based on contributions and governance participation.

**(4) Governance Participants**

\- All token holders may participate in governance:

o Propose or vote on data quality standards.

o Decide buyback & burn parameters.

o Vote on DSP upgrades and incentive model adjustments.

Website: https://falcon.finance/

X: [https://x.com/FalconStable](https://x.com/FalconStable)

Docs: [https://docs.falcon.finance/](https://docs.falcon.finance/)

## Additional information extracted from relevant pages

<fetched_info>

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/daffe720-3197-403d-b484-125c2fdb2130.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/daffe720-3197-403d-b484-125c2fdb2130.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/e47a1de2-f4f2-4415-99f2-a7a33af7199c.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/e47a1de2-f4f2-4415-99f2-a7a33af7199c.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/e906c5fb-a6c7-4be5-ac20-2074db72bb61.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/e906c5fb-a6c7-4be5-ac20-2074db72bb61.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/f5d28dc2-843f-420c-9109-1545be1098d3.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/f5d28dc2-843f-420c-9109-1545be1098d3.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/142207bc-17fc-4d5a-b710-e06d5b923976.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/142207bc-17fc-4d5a-b710-e06d5b923976.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/ca2b1a45-33ce-428b-8bb7-22686c603177.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/ca2b1a45-33ce-428b-8bb7-22686c603177.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/ce4def68-ce1b-479a-8ab7-9dff69f65542.png

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/ce4def68-ce1b-479a-8ab7-9dff69f65542.png) - likely not text content

"""

""" https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/268e7386-e2e1-484c-b6d7-e8db234b6023.jpg

Skipped image/binary URL (https://virtualprotocolcdn.s3.ap-southeast-1.amazonaws.com/virtuals/33111/uploads/268e7386-e2e1-484c-b6d7-e8db234b6023.jpg) - likely not text content

"""

""" https://x.com/FalconStable

Skipped social media URL (https://x.com/FalconStable) - requires authentication

"""

""" [Creator profile on Virtuals Protocol](https://api.virtuals.io/api/profile/0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f)

{

"data": {

"id": 437206,

"displayName": null,

"bio": null,

"avatar": null,

"userSocials": [

{

"id": 494651,

"provider": "metamask",

"walletAddress": "0x1abbDac6949c7B4Ea28036d5cf24B8298B79Ec2f",

"metadata": null

}

],

"socials": null

}

}

"""

""" https://docs.falcon.finance/

## https://docs.falcon.finance/mechanism/usdf/peg-stability

Falcon Finance maintains USDf’s peg stability through a combination of delta-neutral and market-neutral strategies. Collateral assets deposited to mint USDf are actively managed to neutralize directional exposure, minimizing the effects of individual asset price movements and broader market fluctuations. This ensures that fluctuations in the underlying collateral do not affect the value backing USDf.

In parallel, the protocol enforces strict overcollateralization requirements. By requiring that the value of deposited assets consistently exceeds the value of USDf minted, Falcon establishes a resilient buffer against volatility in non-stablecoin assets. This ensures that every USDf remains fully backed by assets of equal or greater value, reinforcing the strength of the peg stability.

Together, these mechanisms allow Falcon to maintain synthetic dollar stability, even during periods of significant market fluctuations.

### [Direct link to heading](https://docs.falcon.finance/mechanism/usdf/peg-stability\#cross-market-arbitrage) Cross-market Arbitrage

Falcon also utilizes arbitrage of USDf across both centralized and decentralized spot markets to maintain the peg of USDf. This opportunity is also available to users, who are able to mint or redeem to profit from the price differences of USDf.

- If USDf is above peg (> $1.00):

- KYC-ed Users can mint USDf at peg via Falcon, and sell them on external markets where USDf is trading above peg value.

- If USDf is below peg (< $1.00):

- KYC-ed Users can purchase USDf below peg on external markets and redeem them for $1.00 worth of collateral per token via Falcon.

This incentivizes all parties to actively take part in stablizing USDf at its rightful peg value across various markets.

[PreviousOvercollateralization Ratio](https://docs.falcon.finance/mechanism/usdf/overcollateralization-ratio) [NextsUSDf](https://docs.falcon.finance/mechanism/susdf)

Last updated 2 months ago

## https://docs.falcon.finance/

Our mission is clear: Your Crypto, Your Yields. Falcon aims to empower users and institutions to unlock the true yield potential of their digital assets.

Falcon is built on the foundation of trust, transparency, and robust technology. Our team of experienced professionals brings expertise in blockchain, financial engineering, and quantitative analysis to ensure we deliver a protocol that balances reliability with performance. We are committed to enabling users to maximize their assets while adhering to the highest standards of accountability.

Our mission extends beyond creating a protocol—it’s about fostering a system that prioritizes user returns and sustainable growth.

[NextSupported Assets](https://docs.falcon.finance/supported-assets)

Last updated 2 months ago

## https://docs.falcon.finance/falcon-miles

**Falcon Miles Pilot Season** is focused on incentivizing core activities on the Falcon app and DeFi liquidity activities. Users can earn Miles by performing eligible actions such as minting USDf, staking, restaking, contributing liquidity, or trading on DeFi pools.

### [Direct link to heading](https://docs.falcon.finance/falcon-miles\#how-it-works) How it Works

Falcon Miles operates on a multiplier-based system. For each eligible activity you perform, points are awarded based on the USD value of the activity, either the USDf minted or the total value locked (TVL) of the collateral.

**Example 1: Minting USDf via the Classic Mint with Non-stablecoins**

If you mint USDf worth 10,000 and the multiplier for this action is 8x, you will receive 80,000 Miles.

**Example 2: Holding USDf for a day.**

If you hold $10,000 worth of USDf in your wallet for one day and the daily holding multiplier is 6x, you will earn 60,000 Miles.

> **Note:** The "Daily Earned Miles" displayed on your dashboard reflect the Miles earned from **the previous day’s activities**.

_**Disclaimer: Any attempt to abuse the program will result in removal of points or disqualification, to ensure fair distribution to the Falcon community.**_

### [Direct link to heading](https://docs.falcon.finance/falcon-miles\#earning-miles) Earning Miles

There are several ways to earn Miles during this Pilot Season:

1. **Mint, Stake, Hold**

1. You can mint USDf through either Classic or Innovative Mint, with rewards varying based on the type of collateral supplied. Once minted, holding USDf in your wallet earns you Miles passively over time. You can also stake your USDf to receive sUSDf, or go further by restaking sUSDf into Boosted Yield vaults for even higher long-term returns. The longer you hold or commit, the more you earn.

2. **DeFi Liquidity**

1. Beyond the Falcon app, you can earn Miles by contributing USDf liquidity to supported decentralized exchanges, such as Uniswap, Curve, Balancer, PancakeSwap, and Bunni.

1. Retroactive rewards will be issued to early liquidity providers, recognizing those who helped seed the protocol from the start.

2. Trading activity on Uniswap v3 is now eligible for Miles. You’ll earn daily rewards based on the total volume you trade.

3. **Referrals**

1. Through our referral program:

- Earn up to 10% of the Miles your referee earns.

- Set your own kickback: give as much (or as little) back as you like.

Please note:

- Referrer: You’ll only earn Miles if the person you invite connects their wallet to Falcon app for the first time using your referral link.

- Referee: To receive your referral bonus, you must have never connected to Falcon app before, and you must use a referral link on your first connection.

You can find and customize your referral link on the [Miles page](https://app.falcon.finance/miles).

4. **Social Tasks**

1. Be part of our community and earn Miles, whilst staying plugged into the latest updates of Falcon's roadmap and milestones.

Current multiplier values and eligible activities are listed on the [Miles page](https://app.falcon.finance/miles). Please note that improvements and updates are ongoing during this pilot season.

[PreviousKnow Your Customer (KYC)](https://docs.falcon.finance/know-your-customer-kyc) [NextOverview](https://docs.falcon.finance/mechanism/overview)

Last updated 13 days ago

## https://docs.falcon.finance/mechanism/usdf/minting-mechanisms/innovative-mint

_**Disclaimer: The minimum amount required to initiate an Innovative Mint is USD$50,000 worth of eligible non-stablecoin collateral. Users should contact support@falcon.finance for more information or assistance with the process.**_

The Innovative Mint allows users to mint USDf by depositing non-stablecoin assets while maintaining limited exposure to potential price appreciation. Collateral is locked for a fixed term ranging from 3 to 12 months. At the time of minting, the users will have to set the following key parameters: tenure, capital efficiency level, the strike price multiplier. These parameter will determine the initial amount of USDf minted, the liquidation price, and the strike price.

The user's collateral is monitored throughout the lock-up period. Depending on price movements during or at the end of the term, there are three possible outcomes:

**1\. If the collateral price drops below the liquidation price at any time during the term:**

The collateral is liquidated to protect the protocol’s collateral backing. In this case, the user does not retain any claim to the original collateral. However, the user continues to hold the USDf that was minted at the start, which can be redeemed for supported stablecoins such as USDT or USDC.

**2\. If the collateral price remains between the liquidation price and the strike price by the end of the term:**

The user may reclaim the full collateral asset by returning the USDf originally minted. This allows the user to regain their asset while still having accessed to USDf liquidity during the term.

**3\. If the collateral price rises and exceeds the strike price during the term or at maturity:**

The collateral is exited. The user no longer retains any claim to the original asset. Instead, they receive an additional USDf payout, calculated as:

(StrikePrice×CollateralAmount)−USDfMinted(Strike Price × Collateral Amount) − USDf Minted(StrikePrice×CollateralAmount)−USDfMinted

This additional USDf reflects the value of the collateral based on the agreed strike level, effectively capturing a predefined upside for the user in USDf terms.

[PreviousClassic Mint](https://docs.falcon.finance/mechanism/usdf/minting-mechanisms/classic-mint) [NextOvercollateralization Ratio](https://docs.falcon.finance/mechanism/usdf/overcollateralization-ratio)

Last updated 1 month ago

## https://docs.falcon.finance/supported-assets

### [Direct link to heading](https://docs.falcon.finance/supported-assets\#stablecoins) **Stablecoins:**

Token

Supported Network(s)

USDT

Ethereum, Tron, Solana

USDC

Ethereum, Solana

DAI

Ethereum

USDS

Ethereum

USD1

Ethereum

FDUSD

Ethereum

### [Direct link to heading](https://docs.falcon.finance/supported-assets\#non-stablecoin-assets) **Non-Stablecoin Assets:**

Token

Supported Network(s)

BTC

Bitcoin

WBTC

Ethereum

ETH

Ethereum

SOL

Solana

XRP

Ripple

TRX

Tron

TON

TON

POL

Polygon

EOS

EOS

NEAR

Near

DEXE

Ethereum

BEAMX

Ethereum

MOVE

Ethereum

FET

Ethereum

COTI

Ethereum

AVAX

Avalanche

QI

Avalanche

SEI

Sei

DOLO

Berachain

MNT

Mantle

TRUMP

Solana

_For any other tokens not listed above, please reach out to the Falcon team for assistance._

[PreviousWelcome](https://docs.falcon.finance/) [NextGlossary](https://docs.falcon.finance/glossary)

Last updated 1 month ago

## https://docs.falcon.finance/glossary

Term

Description

Falcon Account

Falcon Account is a centralized account within Falcon’s CeDeFi platform, functioning as the secure off-chain repository for your asset deposits and locked collaterals.

USDf

USDf is an overcollateralized synthetic dollar minted by Falcon when users deposit eligible assets, such as stablecoins and non-stablecoin assets.

sUSDf

sUSDF is a yield-bearing token, minted when USDf is deposited into Falcon's vaults. Its value increases over time as it accrues yield.

ERC-4626

[ERC-4626](https://ethereum.org/en/developers/docs/standards/tokens/erc-4626/) is a standard used by Falcon to optimize and unify the technical parameters its USDf yield-bearing vaults.

ERC-721

[ERC-721](https://ethereum.org/en/developers/docs/standards/tokens/erc-721/) introduces a standard for Non-Fungible Tokens (NFTs), and is used by Falcon to represent a user's unique locked positions.

Overcollateralization Ratio (OCR)

An overcollateralization ratio is a measure of the value of collateral pledged against the value of USDf minted, where the collateral's value exceeds the mint value.

Overcollateralization Buffer

An overcollateralization buffer refers to the surplus value between a user's total minted USDf and collateral that is kept as a cushion to absorb price volatility of the collateral asset.

Cooldown Period

The cooldown period refers to the time a user has to wait prior to receiving his assets, whether after a redemption or claim.

[PreviousSupported Assets](https://docs.falcon.finance/supported-assets) [NextKnow Your Customer (KYC)](https://docs.falcon.finance/know-your-customer-kyc)

Last updated 2 months ago

## https://docs.falcon.finance/mechanism/usdf

USDf is Falcon Finance’s overcollateralized synthetic dollar, minted when users deposit eligible collateral assets, including stablecoins (e.g., USDT, USDC, DAI) and non-stablecoin assets (e.g.,BTC, ETH, and [select altcoins](https://docs.falcon.finance/supported-assets)). The overcollateralization framework is designed to ensure that the value of the collateral consistently exceeds the value of the USDf issued, preserving its stability across varying market conditions.

Collateral deposited to mint USDf is managed through neutral market strategies, maintaining full asset backing while minimizing the impact of directional price movements. This approach reinforces the strength and reliability of USDf as an overcollateralized synthetic dollar.

[PreviousOverview](https://docs.falcon.finance/mechanism/overview) [NextMinting Mechanisms](https://docs.falcon.finance/mechanism/usdf/minting-mechanisms)

Last updated 2 months ago

## https://docs.falcon.finance/mechanism/overview

The diagram below provides an overview of how users' deposits into Falcon are stored and utilized.

There are several key parties that users should be aware of:

Party

Description

Users

This refers to anyone who utilizes Falcon's range of features, such as depositing/withdrawing, minting/redeeming, staking/unstaking, and restaking/claiming.

Custodians /

OES Providers

This refers to third-party custodial solutions that Falcon employs to store and secure users' deposits. These include Ceffu (MirrorX), and Fireblocks (CVA).

Centralized Exchanges (CEXs)

These refer to the various centralized exchanges that Falcon employs yield generating strategies like price arbitrage on. These include Binance, and Bybit.

Liquidity Pools

These refer to the various venues that Falcon utilizes users' collateral to provide liquidity in exchange for yield.

Staking Pools

These refer to the various venues that Falcon stakes users' collateral to secure various networks in exchange for yield.

### [Direct link to heading](https://docs.falcon.finance/mechanism/overview\#general-flow-of-user-deposits) General Flow of User Deposits

1. Users deposit collateral assets into Falcon - these can range from stablecoins to non-stablecoin assets. USDf is minted in return.

2. All user deposits are routed to third-party custodians where multi-signature (multi-sig) or multi-party computation (MPC) processes are in place to ensure that assets are stored in a secure manner.

1. These processes require multiple approvals from separate, authorized signers before any withdrawal can occur. Consequently, there is no single individual or entity that can unilaterally remove or re-route assets.

2. Falcon does not directly control or hold user-deposited assets in a way that would allow a single party to misappropriate them.

3. Falcon utilizes off-exchange settlement mechanisms that allow for "mirroring" of assets within the custodian accounts onto CEXs, where various strategies are deployed and trades are placed.

4. Falcon deploys a portion of assets into tier-1 on-chain liquidity pools to generate yield through on-chain dex activity and arbitrage.

5. Falcon stakes certain assets on-chain for chains with native staking capabilities to generate additional yield on spot holdings.

[PreviousFalcon Miles](https://docs.falcon.finance/falcon-miles) [NextUSDf](https://docs.falcon.finance/mechanism/usdf)

Last updated 2 months ago

## https://docs.falcon.finance/mechanism/usdf/overcollateralization-ratio

**Overcollateralization Ratio (OCR)** The implementation of an OCR helps to mitigate the impact of market slippage and inefficiencies, ensuring that each USDf minted by all non-stablecoin deposits is fully backed by collateral of equal or greater value. It indicates a user's total value of locked collateral relative to the amount of minted USDf.

OCR=Initial Mark Price of Collateral×Collateral AmountUSDf Minted\\text{OCR} = \\frac{\\text{Initial Mark Price of Collateral} \\times \\text{Collateral Amount}}{\\text{USDf Minted}}

OCR=USDf MintedInitial Mark Price of Collateral×Collateral Amount

OCRs for each non-stablecoin collateral asset are dynamically calibrated based on the asset’s inherent market volatility, liquidity profile, market slippage and historical price behavior. This risk-adjusted approach ensures the protocol’s resilience against adverse price movements while optimizing capital efficiency for users.

Users should also note that the valuation of their collateral is directly tied to the prevailing market price and conditions at the time of collateral deposit.

_Falcon does not guarantee the stability or value of any assets and accepts no liability for any discrepancies or losses arising from market volatility or external factors influencing asset prices._

**Overcollateralization Ratio (OCR) Buffer** AnOCR buffer is the portion of collateral retained by Falcon beyond the value of minted USDf. The buffer serves as a risk mitigation mechanism to safeguard the protocol against market fluctuations. The amount of collateral asset held as an OCR buffer is derived by:

OCR Buffer=(OCR−1)×(Collateral Amount)\\text{OCR Buffer} = (\\text{OCR} - 1) \\times (\\text{Collateral Amount})

OCR Buffer=(OCR−1)×(Collateral Amount)

Reclaiming of the OCR buffer is based on market conditions at the time of claim.

- If the current market price ≤ initial mark price (of the collateral asset): Users will reclaim the full unit amount of the buffer

- If the current market price ≥ initial mark price: Users will reclaim the USD-equivalent value of the buffer based on the initial mark price

[PreviousInnovative Mint](https://docs.falcon.finance/mechanism/usdf/minting-mechanisms/innovative-mint) [NextPeg Stability](https://docs.falcon.finance/mechanism/usdf/peg-stability)

Last updated 2 months ago

## https://docs.falcon.finance/know-your-customer-kyc

Prior to depositing, individual users will be required to undergo KYC (Know Your Customer) processes respectively. These are regulatory processes intended to verify the identity of Falcon's users, ensuring adherence to Anti-Money Laundering (AML) regulations and maintaining secure and compliant transaction practices.

### [Direct link to heading](https://docs.falcon.finance/know-your-customer-kyc\#kyc-process) KYC Process

New users to Falcon may initiate this process by starting a [deposit](https://app.falcon.finance/transfer/deposit), [withdrawal](https://app.falcon.finance/transfer/withdraw), [mint](https://app.falcon.finance/swap/mint) or [redeem](https://app.falcon.finance/swap/redeem) action, at which a prompt for the user to choose their account type will appear.

Users select 'Individual' and click the 'Get my KYC/KYB link'. They will then receive a unique QR code and link to proceed.

Throughout the process, users will be required to provide a range of personal information and data. These include:

- Country of Residence

- Email

- Telegram Handle

- Identity Document

- Supported document types vary across different issuing countries

- Proof of Address

- Documents submitted must clearly state users' full legal names, residential address, and be no older than 3 months

- Examples include:

- Bank statements

- Telecom/Utility/Tax bills

- Voter registration documents

- Lease agreements

- Official government-issued letters

- For Chinese citizens or residents, submitting bank statements is strongly recommended. Bank statements typically include your full legal name and residential address clearly, facilitating a more efficient verification process

- Utility bills from platforms such as WeChat or Alipay usually do not meet Falcon's requirements and often result in document resubmission and delays

- Employment Status

- Source of Funds

- Political Exposure

The entire KYC verification review process ranges from a few minutes to 5 business days. Do note that verification times may increase during periods of high market demand or increased verification volumes.

In the case where users' applications have been rejected, they may be required to resubmit specific documents or provide additional information. Users are encouraged to review feedback provided carefully and proceed as instructed.

However, if submissions still do not meet Falcon's regulatory requirements, rejection decisions will be final. If users have any subsequent questions or require assistance, they can reach out at support@falcon.finance.

[PreviousGlossary](https://docs.falcon.finance/glossary) [NextFalcon Miles](https://docs.falcon.finance/falcon-miles)

Last updated 2 months ago

## https://docs.falcon.finance/mechanism/usdf/minting-mechanisms/classic-mint

_**Disclaimer: The minimum amount required to initiate an Classic Mint is USD$10,000 worth of eligible stablecoin and non-stablecoin collateral. Users should contact support@falcon.finance for more information or assistance with the process.**_

**Stablecoins vs Non-Stablecoin Assets** Users minting USDf with stablecoins will do so at a 1:1 ratio, while users minting with non-stablecoin assets will be subject to an overcollateralization ratio (OCR). As indicated in the previous section, OCRs will vary based on the non-stablecoin asset's risk profile.

Refer to the [App Guide](https://docs.falcon.finance/resources/app-guide) for further details on different deposit processes.

**Express Mint** An Express Mint is an extra feature provided for users using the Classic Mint mechanism. It offers users two additional options in the process of minting their USDf. Compared to a regular mint where users simply receive the amount of USDf minted, and are required to proceed with further processes like staking and restaking manually, Express Mint users are able to bypass these automatically.

- Option 1: Mint & Stake

- This option automatically stakes users' USDf after it is minted, directly returning users sUSDf instead of USDf at the end of the process.

- Option 2: Mint, Stake, & Restake

- This option requires users to pick between available fixed-term tenures, automatically staking their' USDf after it is minted, then restaking the returned sUSDf into the chosen vaults.

- Users will receive an ERC-721 NFT representing their locked position instead of USDf or sUSDf at the end of the process

Refer to the [sUSDf](https://docs.falcon.finance/mechanism/susdf) and [Restaking](https://docs.falcon.finance/restaking) sections for further details on staking and restaking respectively.

[PreviousMinting Mechanisms](https://docs.falcon.finance/mechanism/usdf/minting-mechanisms) [NextInnovative Mint](https://docs.falcon.finance/mechanism/usdf/minting-mechanisms/innovative-mint)

Last updated 1 month ago

"""

""" https://falcon.finance/

## https://falcon.finance/about

# About Falcon Finance

###### Built by blockchain and financial engineering experts, Falcon Finance ensures consistent, competitive, and institutional-grade returns.

[Get Started](https://app.falcon.finance/)

### Unlock the Future of Synthetic Dollars

Our Mission

#### To create transparent, secure, and sustainable synthetic dollars to drive global innovation and empower users to unlock their full financial potential.

## Driven by a passion for excellence, we deliverinstitutional-grade yields through diverse trading strategies, and aim to ensure transparency, and growth for all users.

## Start Earning Today. Create Your Account.

[Get Started](https://app.falcon.finance/)

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

About Falcon Finance \| Synthetic Dollar Protocol

Chat Widget

## https://falcon.finance/contact-us

# Contact Us

###### Get in touch with our sales team

Form [Skip to form](https://js.hsforms.net/ui-forms-embed-components-app/frame.html?_hsPortalId=48402161&_hsFormId=c9185843-2a91-44ab-9ee9-040644f11679&_hsIsQa=false&_hsHublet=na1&_hsDisableScriptloader=true&_hsDisableRedirect=true&_hsInstanceId=6d0ad2ab-f596-453f-bbe2-00a68308b6f8#main)

First Name\*

Last Name\*

Email\*

Telegram\*

Organization\*

Category\*

- Financial Institutional

- DeFi Protocol

- Liquidity Provider

- Service Provider

- Investor

- Others

Message\*

reCAPTCHA

Recaptcha requires verification.

protected by **reCAPTCHA**

[Privacy](https://www.google.com/intl/en/policies/privacy/) \- [Terms](https://www.google.com/intl/en/policies/terms/)

[Privacy](https://www.google.com/intl/en/policies/privacy/) \- [Terms](https://www.google.com/intl/en/policies/terms/)

Falcon Finance needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our [Privacy Policy](https://docs.falcon.finance/privacy-policy).

Submit

reCAPTCHA

Select all images with **cars** Click verify once there are none left

| | | |

| --- | --- | --- |

|  |  |  |

|  |  |  |

|  |  |  |

Please try again.

Please select all matching images.

Please also check the new images.

Please select around the object, or reload if there are none.

Verify

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

Chat Widget

## https://falcon.finance/

# Next-Generation Synthetic Dollar

###### Leading with innovation, security, and yield.

[Get Started](https://app.falcon.finance/)

## $486.8m

Falcon Finance TVL

## $485.8m

USDf Supply

## 9.2%

sUSDf APY

## Minting & Staking

Mint USDf, an overcollateralized synthetic dollar, by staking eligible digital assets.

Stake USDf to create sUSDf, a yield-bearing token that provides users with diversified, institutional-grade trading strategies beyond blue chip basis spread arbitrage.

Experience transparent, secure financial solutions designed for resilient yield performance in any market condition.

[Learn more](https://docs.falcon.finance/)

##### 01Access the Ecosystem

Deposit your digital assets, including stablecoins, bluechip, and altcoins, to mint USDf. Unlock your earning potential with Falcon Finance.

##### 02Stake USDf for Yield

Stake USDf to mint sUSDf and earn a base yield. Enjoy competitive yields and the flexibility to withdraw your assets any time.

##### 03Restake

Amplify your returns by locking sUSDf for a fixed-term staking. Leverage the power of time to maximise your yields.

## Your Crypto, Your Yield

Falcon Finance delivers robust synthetic dollar solutions for diverse users.

[Start Now](https://app.falcon.finance/)

###### For Traders and Investors

Leverage USDf to optimize your trading strategy. Convert digital assets into USDf, unlock liquidity, and access competitive yields.

###### For Crypto Projects and Founders

Redefine treasury management with USDf and sUSDf. Preserve reserves, maintain liquidity, and earn yields for your project.

###### For Exchanges and Retail Platforms

Offer cutting-edge access to yield-generating products with liquidity, security, and growth potential.

[**For Traders and Investors** \\

\\

Leverage USDf to optimize your trading strategy. Convert digital assets into USDf, unlock liquidity, and access competitive yields.](https://falcon.finance/solutions)

[**For Crypto Projects and Founders** \\

\\

Redefine treasury management with USDf and sUSDf. Preserve reserves, maintain liquidity, and earn yields for your project.](https://falcon.finance/solutions)

[**For Exchanges and Retail Platforms** \\

\\

Offer cutting-edge access to yield-generating products with liquidity, security, and growth potential.](https://falcon.finance/solutions)

## Unlock the Future of Synthetic Dollars

[Learn More](https://docs.falcon.finance/)

## Pioneering the Next Generation of Yield

[Get Started](https://app.falcon.finance/)

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

Chat Widget

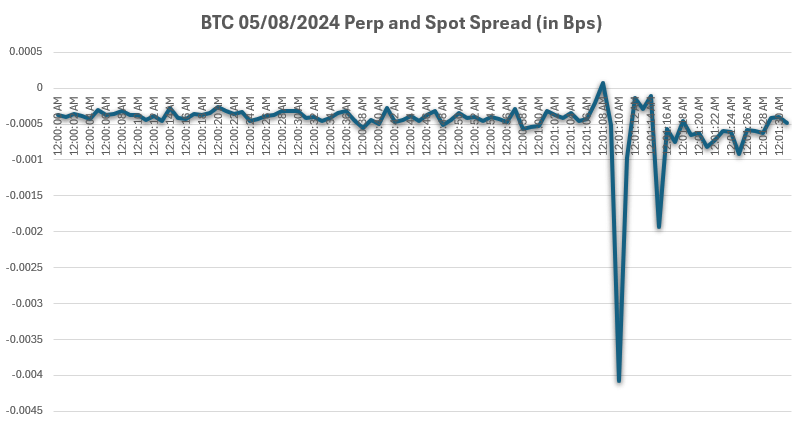

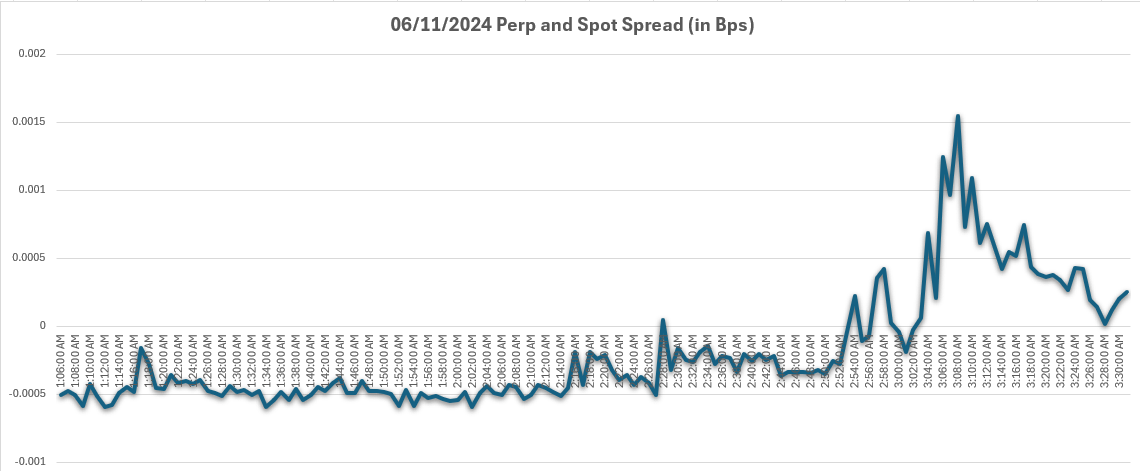

## https://falcon.finance/news/how-falcon-finance-turns-crypto-volatility-into-yield

# How Falcon Finance Turns Crypto Volatility into Yield

Education

March 13, 2025

The crypto market has historically experienced more volatility than traditional finance (TradFi) market.

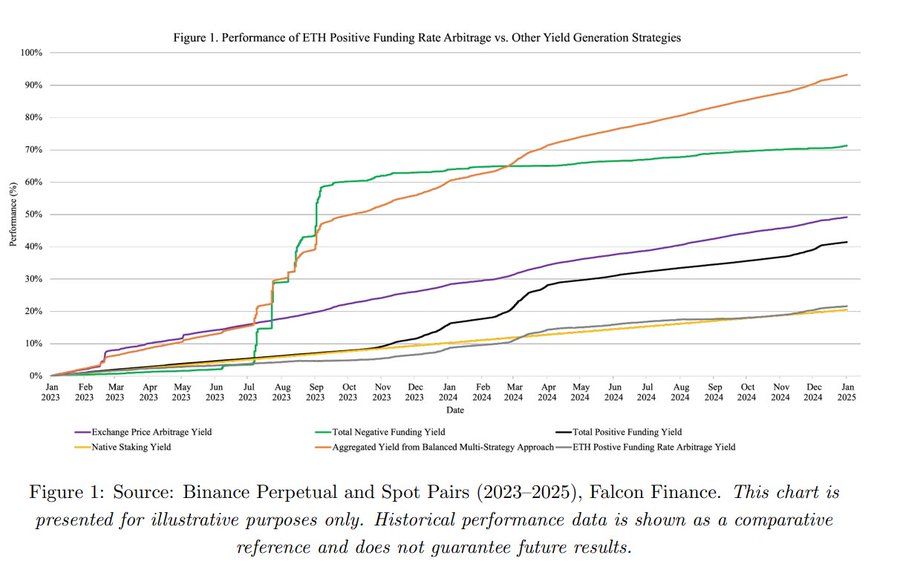

While extreme price swings can unsettle traders, Falcon thrives in volatility, seizing unique yield opportunities during both bullish and bearish conditions.

In this article, we will explore how Falcon navigates market inefficiencies to maximize returns.

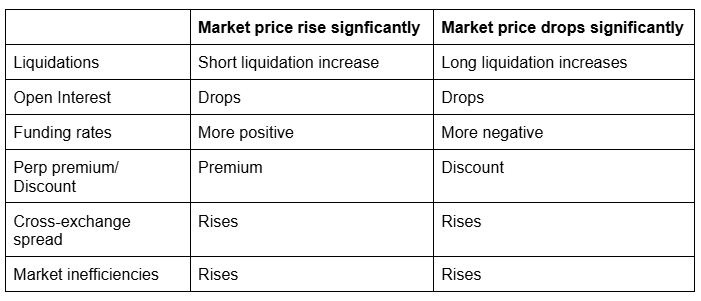

In volatile periods, there are some market inefficiencies which emerge:

- Liquidations surge, causing forced position closures.

- Funding rates diverge, creating opportunities for strategic positioning.

- Cross-exchange spreads widen, opening arbitrage windows.

These conditions pave the way for Falcon's sophisticated yield-generating strategies.

During downturns, perpetual (perp) prices often trade below spot prices due to mass liquidations. Falcon leverages these price dislocations by unwinding short positions, capturing the discount, and profiting from negative funding rate strategies—earning yield while maintaining an approach that manages and balances risk.

When the market surges, perp prices frequently trade above spot, which leads to a premium environment. In this situation, Falcon capitalizes on this by unwinding long positions at a premium while simultaneously earning yield from positive funding rate arbitrage. Regardless of market direction, Falcon’s adaptive strategies ensure that volatility becomes a profit engine.

Now, beyond funding rate arbitrage, high volatility also widens spreads between exchanges, creating cross-exchange arbitrage opportunities. By systematically identifying and executing trades on these pricing discrepancies, these gaps can be capitalized to capture extra yield for users.

From our track record, Falcon’s dynamic position management has been observed to capture higher funding yields in both bullish and bearish swings, thus proving to consistently outperform major volatility events by dynamically managing positions.

By capturing funding rate yields and optimizing arbitrage across exchanges, Falcon not only mitigates risk but also enhances returns during market upheavals.

To wrap up, we can see that while volatility is a double-edged sword for traders, but Falcon navigates market turbulence well and uses it as a strategic advantage. Through a blend of dynamic position management, funding rate optimization, and cross-exchange arbitrage, Falcon ensures that users benefit from both bullish and bearish swings.

In the ever-changing crypto landscape, Falcon doesn’t just survive volatility—we will continue to thrive in it.

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

How Falcon Finance Turns Crypto Volatility into Yield

Chat Widget

## https://falcon.finance/news/falcon-finance-crosses-100-million-tvl-in-closed-beta

# Falcon Finance Crosses $100 Million TVL in Closed Beta

Announcements

March 26, 2025

**Dubai, 26 March 2025** – Falcon Finance, a next-generation synthetic dollar protocol, has officially reached its first $100 million Total Value Locked (TVL) milestone during its Closed Beta phase. The controlled rollout has enabled the team to monitor the protocol in production and gather meaningful user feedback. Insights on interface and overall user experience will help guide improvements ahead of a broader public release.

Since its inception, Falcon Finance has seen rapid adoption driven by demand for yield-generating synthetic dollars and strong engagement from early adopters. "Hitting $100 million is a validation of our infrastructure and the trust that our early users have placed in us,” said Andrei Grachev, Managing Partner of Falcon Finance. “We’re proud of the momentum, and we are just getting started.”

Falcon Finance’s overcollateralized synthetic dollar, $USDf, was also recently listed on both Curve Finance and Uniswap. $USDf is now live on secondary markets, giving users the ability to trade and access liquidity across Ethereum’s most trusted decentralized exchanges.

Falcon Finance also supports 16+ collaterals across Ethereum, TON, Polygon, NEAR, Bitcoin, and more — including assets from leading Layer 1 and Layer 2 ecosystems: $POL (Polygon), $FET (Fetch.ai), $COTI (COTI Network), $BEAMX (BuildOnBeam), $DEXE (Dexe Network), $MOVE (Movement) and more to be announced in the coming weeks.

In addition, Falcon Finance has also integrated Fireblocks and Ceffu, a major upgrade to asset custody and institutional security. This helps eliminate exchange counterparty risk by locking user funds in secure MPC-based wallets, while all trading is executed via mirrored positions — ensuring users retain full asset ownership without depositing assets into exchange hot wallets.

The platform continues to expand its integrations with leading wallets, protocols, and Layer 1 and Layer 2 networks — solidifying its position as a core infrastructure player in the decentralized finance space. As part of its commitment to trust, Falcon Finance will soon unveil its transparency information where users can access daily metrics on assets held in custody and portfolio valuations across centralized exchanges. This initiative sets a benchmark for accountability and openness.

**About Falcon Finance**

Falcon Finance is a next-generation synthetic dollar protocol. Preserving users’ multi-assets with industry competitive yields across any market conditions, it sets a new standard in the industry, along with transparency, security, and institutional-grade risk management. Learn more: [https://falcon.finance/](https://falcon.finance/)

**Press Contact:**

United Arab Emirates, Dubai

Andrei Grachev

Managing Partner

[press@falcon.finance](mailto:press@falcon.finance)

Dubai, United Arab Emirates

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

Falcon Finance Crossed $100 Million in TVL

Chat Widget

## https://falcon.finance/verification

## Verify the Team

Please use this verification tool to check whether a contact, website, or link is authorised by Falcon Finance.

Telegram User

Twitter / X

Email Address

Website

Search

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

Verify Social Media Accounts of Falcon Finance Team

Chat Widget

## https://falcon.finance/news/paving-the-way-for-web3-growth-andrei-grachev-and-falcon-finance

# Paving the Way for Web3 Growth: Andrei Grachev and Falcon Finance

January 23, 2025

This article was originally published in _Entrepreneur Middle East_, an international franchise of _Entrepreneur Media_. Written by Aalia Mehreen Ahmed, it explores Andrei Grachev’s ambitious plans to drive innovation and adoption in the Web3 space through Falcon Finance, a revolutionary yield-bearing stablecoin project under DWF Labs.

###### **Falcon Finance: Redefining Stablecoins**

As the Managing Partner of DWF Labs, Andrei Grachev has spearheaded numerous initiatives to support Web3 innovation and financial growth. One of the most promising of these is Falcon Finance, a multi-collateralized, yield-bearing stablecoin platform designed to unlock additional liquidity for institutional investors, companies, and everyday users.

Grachev describes Falcon Finance as a transformative solution for the crypto ecosystem, allowing users to access extra cash for investments and trading without the need to sell their existing assets. “Falcon Finance will not only enable users to leverage their holdings but also generate additional yield through our carefully engineered financial strategies,” he says.

The stablecoin ecosystem offered by Falcon Finance reflects DWF Labs’ commitment to blending innovation with practical financial solutions. By using multi-collateralized mechanisms, Falcon Finance ensures security, transparency, and scalability for its users, positioning itself as a trusted tool for crypto enthusiasts and institutional players alike.

###### **Fostering Regulatory Alignment**

Grachev emphasizes the importance of working closely with regulators to ensure compliance and long-term sustainability for Falcon Finance. “We are actively engaging with standards bodies such as the Securities and Commodities Authority (SCA), Abu Dhabi Global Market (ADGM), and the Virtual Assets Regulatory Authority (VARA),” he notes. By collaborating with these entities, Falcon Finance is building a robust framework that aligns with regional and global regulatory standards, thereby advancing the adoption of Web3 technologies.

###### **The Vision for a Tokenized Future**

Falcon Finance is not just about liquidity; it is also a cornerstone in DWF Labs’ broader vision of creating a fully tokenized financial ecosystem. Grachev explains, “Our efforts in tokenization extend beyond individual assets to entire banking structures. We aim to combine regulatory licensing and advanced technology to support a sustainable, fully tokenized financial system.”

This forward-thinking approach integrates Falcon Finance’s stablecoin solutions with DWF Labs’ overarching mission of bridging the gap between traditional and digital finance, creating a seamless experience for users across both realms.

###### **Driving Innovation and Growth**

Grachev’s belief in Falcon Finance stems from its potential to act as a transformative force in the Web3 space. With its unique multi-collateralized, yield-bearing stablecoin model, Falcon Finance provides a strategic advantage for users seeking stability, growth, and flexibility. By leveraging DWF Labs’ expertise in liquidity provision and market-making, Falcon Finance aims to become a vital tool in the rapidly evolving digital asset landscape.

“Falcon Finance is a big part of our roadmap,” Grachev shares. “It will foster stability and growth within the digital asset ecosystem while contributing to the convergence of traditional finance and crypto.”

###### **Looking Ahead**

With Falcon Finance at the heart of its strategic plans, DWF Labs, under Grachev’s leadership, is paving the way for a future where stablecoins, tokenization, and advanced financial strategies redefine the global financial system. Grachev remains optimistic about the role Falcon Finance will play in advancing Web3 adoption and creating sustainable growth opportunities for all.

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

What is Falcon Finance? Protocol's Founder Explained

Chat Widget

## https://falcon.finance/news/falcon-finance-enhances-asset-security-with-fireblocks-off-exchange

# Falcon Finance Enhances Asset Security with Fireblocks Off Exchange

Partnerships

March 7, 2025

**Dubai, 7 March, 2025** \- [Falcon Finance](https://falcon.finance/), the next-generation synthetic dollar protocol, today announced that it has integrated Fireblocks Off Exchange, significantly enhancing the security framework for all user assets. Unlike custodial solutions that transfer counterparty risk to centralised clearing parties, Fireblocks Off Exchange takes a technology-first approach, enabling Falcon Finance’s clients to mitigate all forms of exchange counterparty risk by programmatically locking funds in secure MPC-based shared wallets.

All trading activities utilise mirrored positions while the underlying assets remain in secure cold storage, effectively reducing centralized exchange risks that have plagued the industry. This strategic implementation strengthens Falcon Finance’s security by keeping user assets safer from exchange risks in the synthetic dollar space.

Fireblocks is the world’s most trusted and proven digital asset infrastructure company, empowering organizations of all sizes to build, run and grow their business on the blockchain. With the industry’s most secure, scalable and comprehensive platform, Fireblocks streamlines custody, tokenization, payment, settlement, and trading operations across the largest ecosystem of exchanges, custodians, banks, payment providers and stablecoin issuers in the world.

"User asset security is our absolute priority at Falcon Finance," said Andrei Grachev, Managing Partner at Falcon Finance. "By building on Fireblocks' institutional-grade custody technology and off-exchange solution, we've created a secure environment where assets never touch exchange hot wallets, eliminating a critical vulnerability in the custody chain."

This integration will deliver three key security benefits:

1. **Off Exchange Asset Protection:** All user deposits are secured by Fireblock while Falcon’s trading operations on centralised exchanges are conducted through mirrored positions, ensuring that users retain full ownership of their assets without exposing them to exchange-related risks.

2. **Greater Insulation from Exchange Risk:** User assets maintain absolute separation from exchange hot wallets, mitigating vulnerability to exchange-level security incidents.

3. **Institutional-Grade Security:** Falcon Finance leverages Fireblocks' advanced Multi-Party Computation (MPC) technology, distributing cryptographic key shards across multiple secure nodes to eliminate single points of failure. This implementation combines enterprise-grade security with operational efficiency, ensuring transaction integrity without compromising performance.

Falcon Finance’s integration with Fireblocks marks a significant milestone in its commitment to secure and transparent digital asset management. Moving forward, Falcon Finance will continue advancing its security infrastructure and exploring new innovations to protect user assets and maintain sustainable yields.

For more information about Falcon Finance and its security infrastructure, visit [https://falcon.finance](https://falcon.finance/)

### **About Falcon Finance**

Falcon Finance is a next-generation synthetic dollar protocol. Preserving users’ multi-assets with industry competitive yields across any market conditions, it sets a new standard in the industry, along with transparency, security, and institutional-grade risk management.

### **Press Contact:**

Andrei Grachev

Managing Partner

[Press@falcon.finance](mailto:Press@falcon.finance)

Dubai, United Arab Emirates

This website uses cookies to ensure you get the best experience on our website.

Acknowledge

Chat Widget

## https://falcon.finance/news/negative-funding-rate-arbitrage-unlocking-sustainable-yield-with-falcon-finance

# Negative Funding Rate Arbitrage: Unlocking Sustainable Yield with Falcon Finance

Education

February 27, 2025

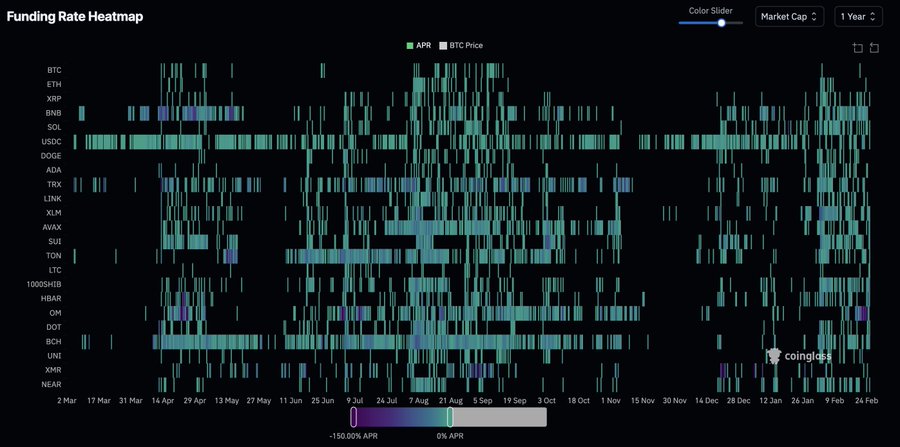

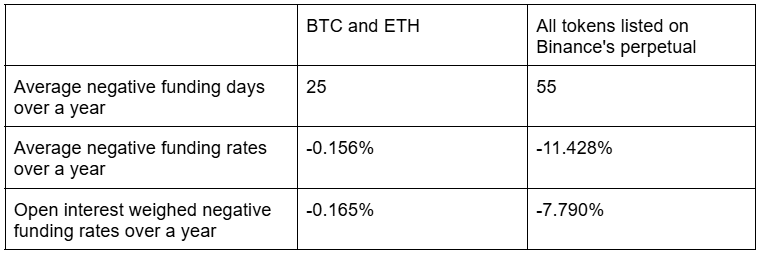

In the world of crypto perpetual markets, most synthetic dollar protocols focus on capturing positive funding rate opportunities. However, this approach only covers half the potential for sustainable yield generation. Falcon expands beyond traditional models by incorporating negative funding rate arbitrage into its strategy, leveraging a diverse collateral pool to unlock delta-neutral yield generation.

Let’s dive into how this works and why it presents an untapped opportunity for traders and investors alike.

First, we'd begin with explaining what funding rates are and how they are affected by market demand.

Funding rates are periodic payments between long and short positions in perpetual futures markets, ensuring that the contract price remains in line with the underlying spot market. These rates fluctuate based on market demand and can be either positive or negative:

- Positive Funding Rate: When the perpetual contract trades above the spot price, long positions pay short positions.

- Negative Funding Rate: When the perpetual contract trades below the spot price, short positions pay long positions.

This dynamic creates arbitrage opportunities that allow traders to generate consistent, delta-neutral returns by capturing funding rate inefficiencies across different markets.

Funding rate arbitrage serves a critical function in financial markets by reducing mispricing and promoting market efficiency. Falcon strategically exploits funding rate discrepancies to provide liquidity, which helps stabilize perpetual funding rates and aligns them with spot market prices. This, in turn, lowers the cost for perpetual traders and improves overall market stability.

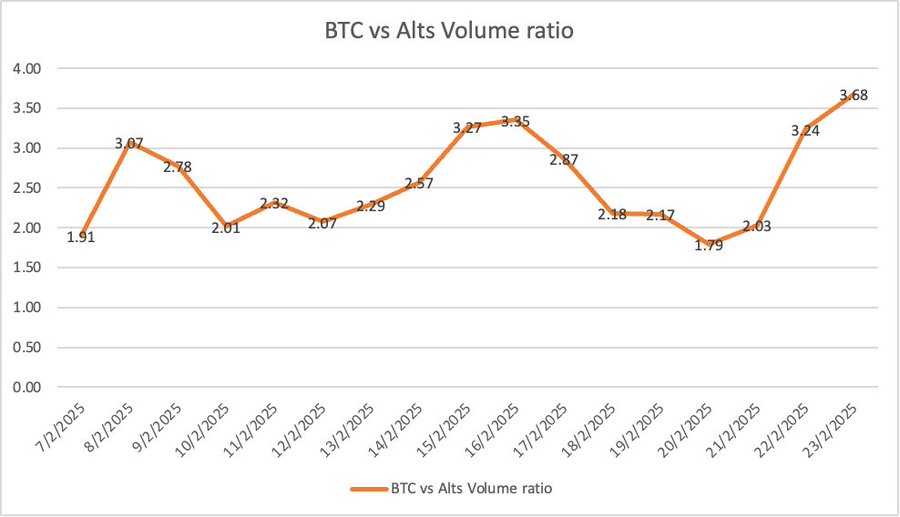

Now, traditional synthetic dollar protocols primarily focus on blue-chip assets and positive funding rate arbitrage. However, Falcon extends its strategy by utilizing a diverse collateral pool that includes BTC, ETH, and altcoins. With this broader asset base, it allows Falcon to capture both positive and negative funding rate arbitrage across various assets, maximizing available yield opportunities.